Recruitment meets business intelligence.

With JobAdder Analytics, you can make informed decisions faster and focus on what you do best – the human side of recruitment.

JobAdder Analytics for Recruitment Agencies

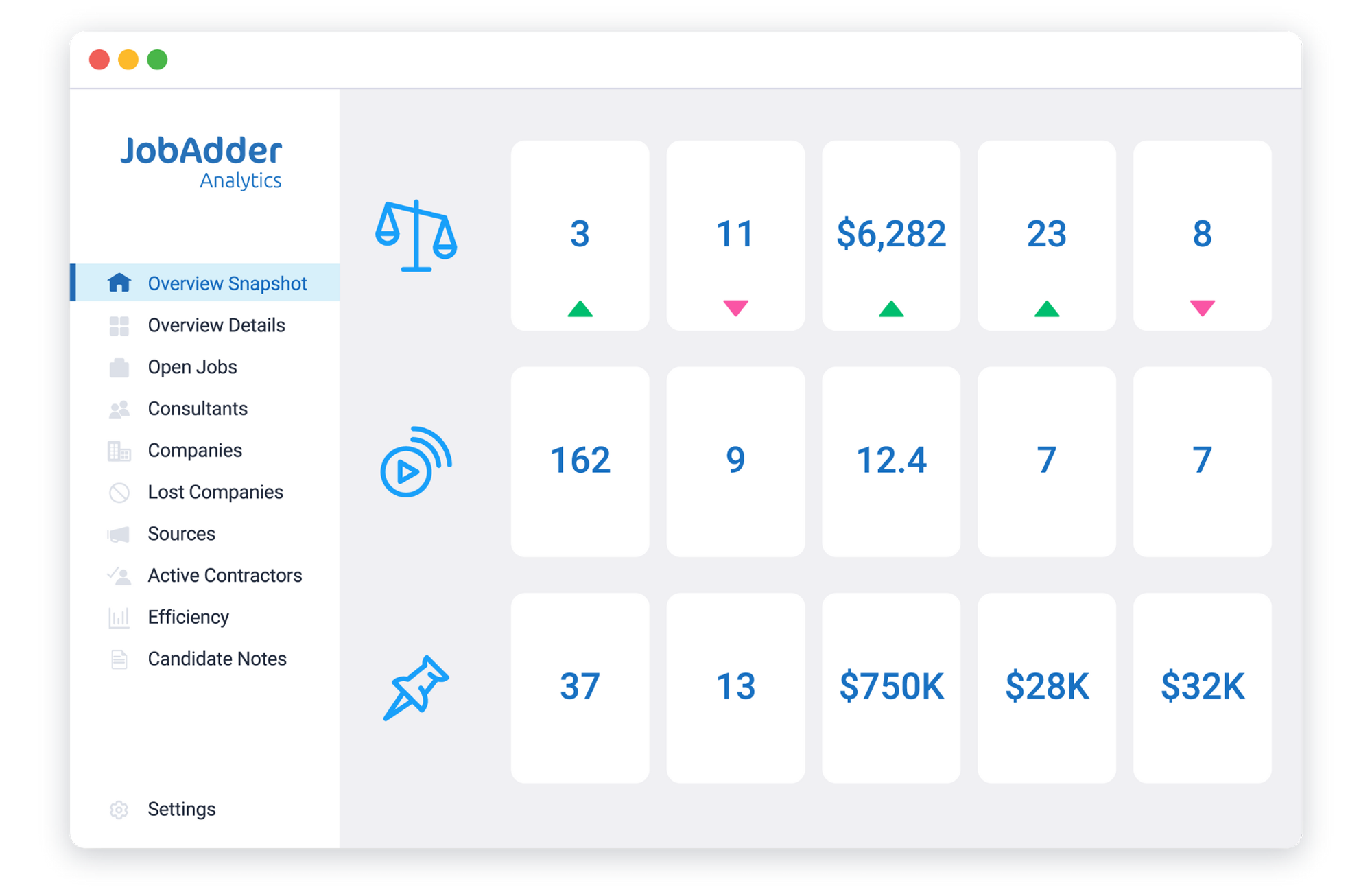

See where to cut costs and increase revenue.

Get a 360-degree view of your perm and temp jobs, placements and business development – all through the lens of revenue growth and cost savings.

Stay on top of consultant performance.

View real-time visual dashboards for top billers, open jobs, won and lost companies, sources, active contractors, and overall efficiency.

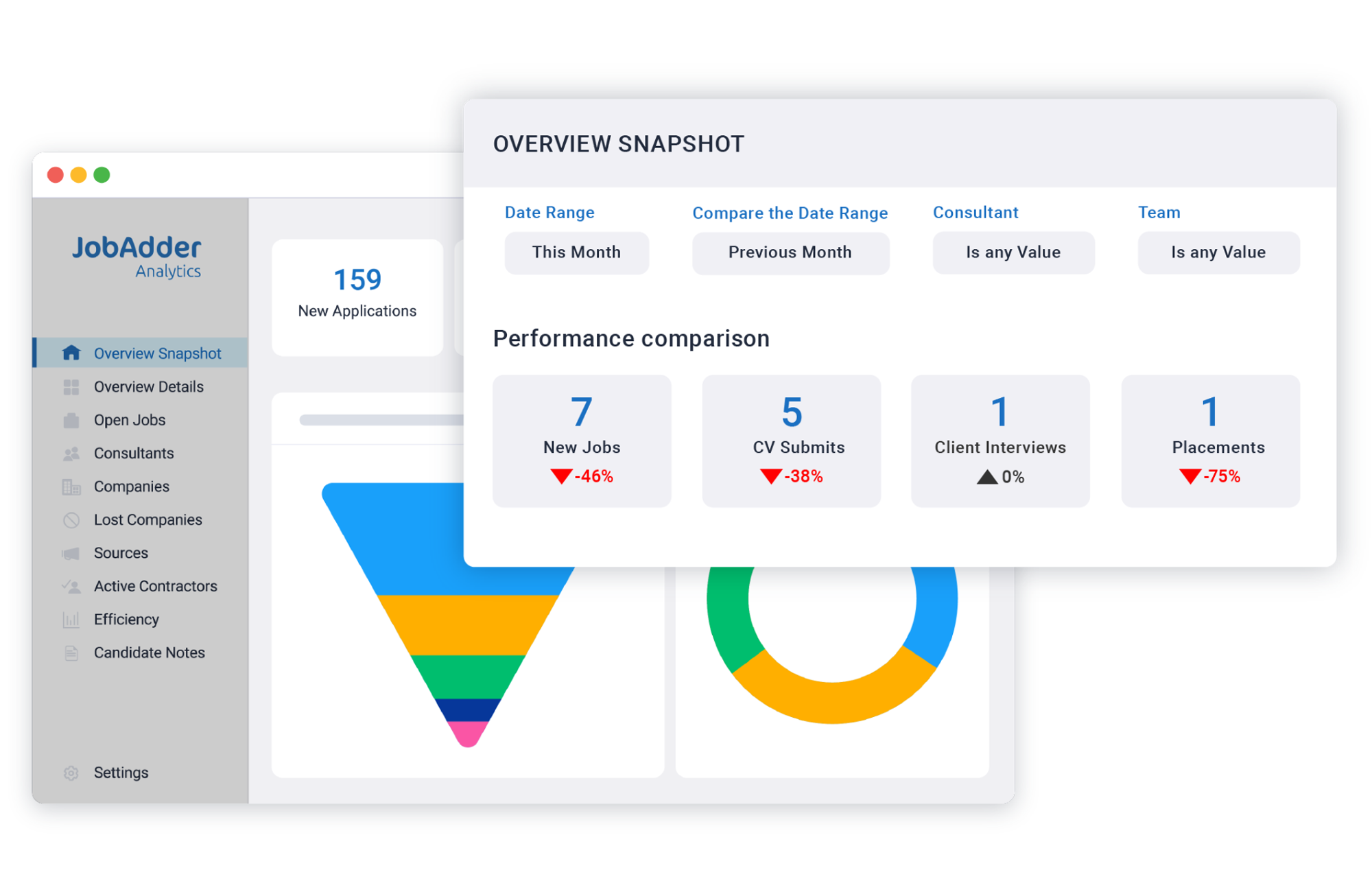

Keep your agency competitive.

Understand how your entire business is performing holistically at a glance, and identify opportunities for improvement and optimisation.

JobAdder Analytics for In-House Teams

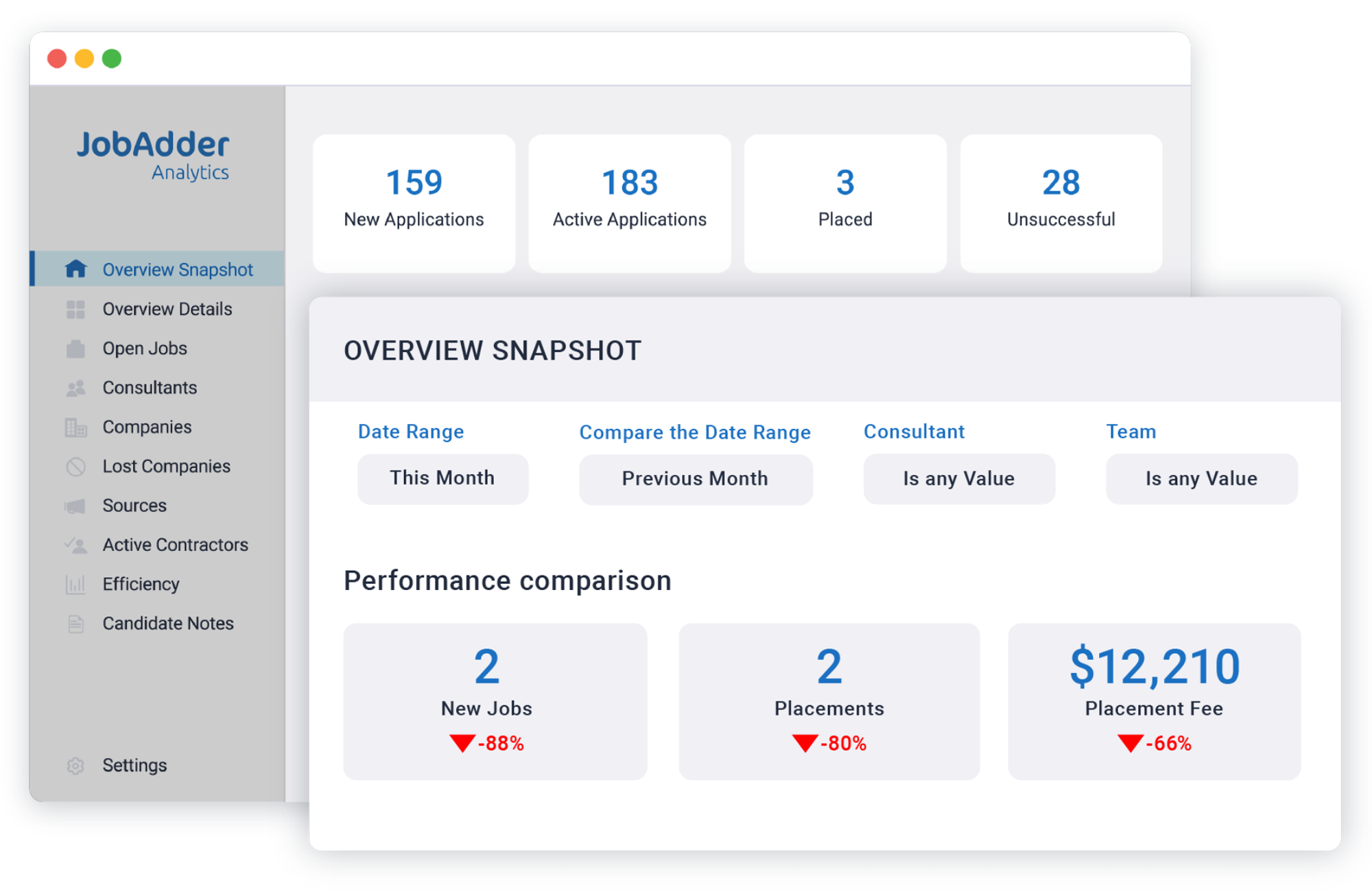

Focus on the right initiatives to improve your hiring process.

Get a 360-degree view of your departments, workplace locations and hiring managers to identify bottlenecks and opportunities within each area.

See where to reduce time spent on recruitment admin.

Track efficiency across key hiring metrics including new jobs, new applications, HR interviews, hiring manager interviews, offers and new hires.

See which candidate sourcing channels are most effective.

See which job boards are bringing in the best candidates and how well you’re leveraging your candidate database for proactive sourcing.

Gain a competitive edge in recruitment and talent acquisition.

Sync with JobAdder ATS and CRM and turn your candidate, client, job and applicant data into real-time dashboards. JobAdder Analytics is an all-in-one solution with options for startup, growing and established agencies and HR teams.

“JobAdder Analytics is really beneficial for me as a business owner, as it allows me to understand some of the opportunities and bottlenecks we’re facing as a business and with individuals in the business, so that we can spend our time and energy solving the right problems.”

Aspect Personnel

Check out the entire JobAdder product suite.

Ready to start making data-driven decisions?

Request pricing for JobAdder Analytics and see how easy it is to connect to JobAdder ATS and CRM.